I’m Ross Kernez—your trusted expert in Reputation Management for Wealth Managers. With over fifteen years of experience, I help high-net-worth families and their advisors protect their name, navigate public scrutiny, and maintain a discreet yet credible online presence. My proactive strategies go beyond crisis control, focusing on long-term reputation stewardship that reflects your values, governance, and generational legacy.

Top Reputation Management Firm Offering Repair Services for Wealth Managers

I’m Ross Kernez, lead strategist at a Top Reputation Management Firm Offering Repair Services for Wealth Managers. With 15 years of experience safeguarding investment professionals’ digital footprints, I excel at removing or suppressing negative coverage, correcting misinformation, and amplifying narratives that showcase your expertise, integrity, and fiduciary duty.

Whether regulatory mentions, client disputes, or media scrutiny threaten your brand, I deliver proactive solutions that align search results with the trust and performance your clients expect. In a high‑stakes industry where perception drives opportunity, your online presence must remain an asset—never a liability. Let’s ensure your leadership shines through every search result, not digital vulnerabilities.

Top Reputation Management Firm Offering Repair Services for Wealth Managers

as seen on

We can Help You to Establish Your Online Presence or Remove Negative Search Results

Speak With an Expert

Do You Need Repair Services for Wealth Managers?

| Option | Effectiveness | Cost |

| #1.Waiting For Negative Articles To Fall Off | Low | Free |

| #2.Submit a DMCA Complaint | Low | Free |

| #3. Hire a Reputation Expert ⭐️Ross Kernez | High | $$ |

| #4. Reaching Out To Journalists | Low | Free |

| #5. Explore Legal Strategies | Medium | $$$ |

| #6. Requesting an Update To a Negative Article | Low | Free |

What are Search Results?

Search results refer to the list created by search engines in response to a query. Search results can be broken down as follows:

Natural search results

(usually on the left-hand side of search engine’s results page) and;

Sponsored search results

(usually on the top and right-hand side of a search engine’s results page). Here you will see websites that have placed PAID ads within the search engine.

Who is Ross Kernez?

Why you should remove negative content online

Our feedbackReviews

How to suppress negative information about you in

Whether you’re battling FUD, fake reviews, or misinformation, I build a stronger online presence that reflects the integrity of your project. Let’s make sure your name—or your token—commands confidence and credibility from page one of Google.

Let's Dive Deeper on How online reputation management works for wealth managers

First, we flood Google with fresh, high-authority coverage your audience can trust—think thought-leadership columns, verified interviews, strategic press releases, and marquee collaborations on publications Google already ranks well in Search and beyond, all optimised for the search terms tied to your name. Next, we harden every digital property you own: your website, bio pages, and social profiles are tightened technically, updated often, and cross-linked so they broadcast relevance and authority. If a news article gets the facts wrong, we lodge a tactful correction with the editor; if content crosses the line into defamation or privacy abuse, we issue formal takedown or de-index requests on solid legal grounds. Finally, we keep a steady drumbeat of positive press and social engagement flowing, so fresh wins rise to the top while outdated or hostile links sink deep into the results—well past page one, where they’re all but invisible.

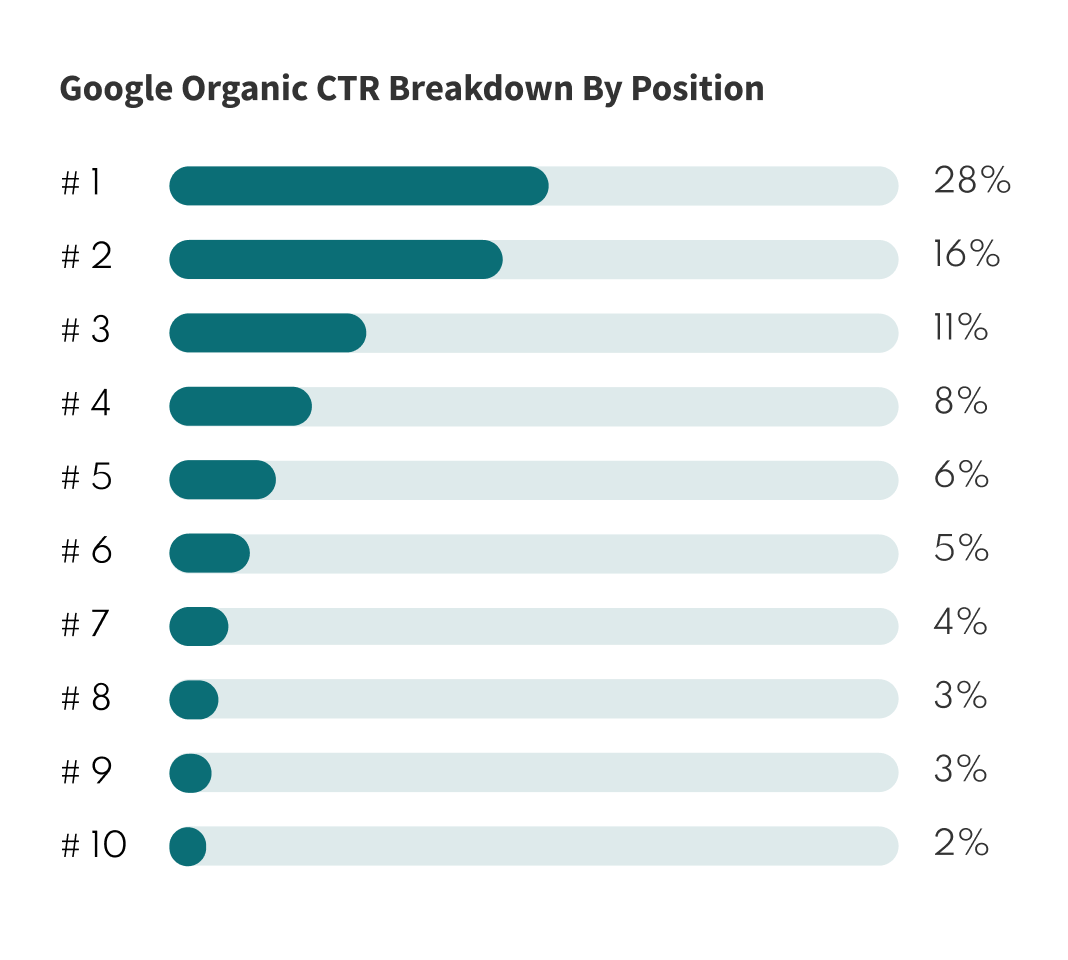

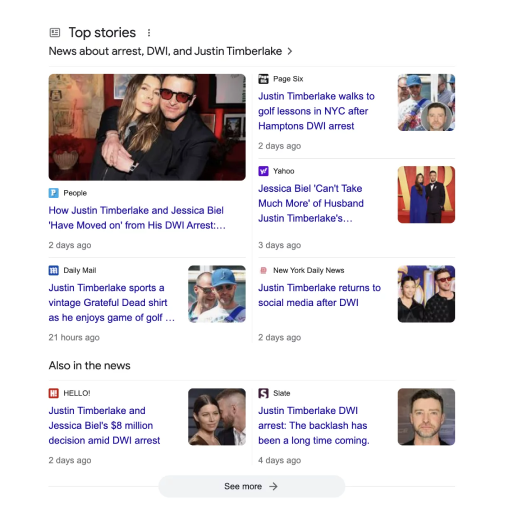

Because Google elevates fresh, authoritative coverage, a single negative headline from a major outlet can vault to the top of your search results—and stay there—simply by virtue of the publisher’s credibility and the story’s recency. That means every new article or broadcast mention effectively renews the shelf-life of the unfavorable narrative, forcing it back onto Page 1 each time it’s updated, syndicated, or quoted. The only reliable countermeasure is to meet Google’s relevance signals with an equally timely stream of positive, high-authority content: an exclusive interview in a respected magazine, a feature on your philanthropic work, or a verified announcement on a well-trafficked platform. By continuously injecting fresh, newsworthy material that reflects your true accomplishments, you can dilute the impact of isolated negative pieces, shift the conversation, and gradually reclaim the real estate at the top of the results page—where first impressions are formed.

Why Google Ranks News Very High in Search?

#1. Waiting For Negative Articles To Naturally Fall Off The First Page

In a competitive investment climate, waiting for negative press to fade on its own is a risk no serious blockchain project should take. If a harmful article or forum thread continues to gain engagement, its visibility won’t fade—it stays on page one, undermining investor confidence and delaying funding.

Our reputation management experts proactively protect your brand. We publish investor-friendly, trust-enhancing content in Arabic and English, fine-tune your digital footprint, and take swift action when your name surfaces in the wrong context. With constant monitoring and precision SEO, we ensure damaging narratives are buried, and your blockchain vision remains the focus.

#2. Submit a DMCA Takedown Notice on Google

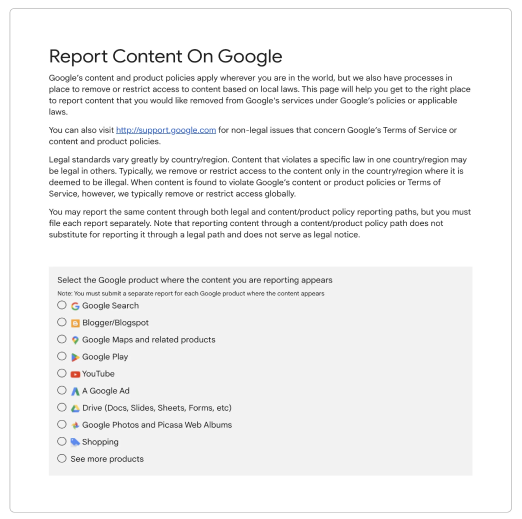

When a regional news outlet or global blog republishes your proprietary content without permission, taking swift action is critical to protect your brand. Start by collecting the infringing URLs and capturing dated screenshots or archived versions that clearly show your ownership. Then, visit Google’s copyright-removal portal (support.google.com/legal/troubleshooter/1114905) and select the appropriate product—Search, YouTube, Images, and more. Fill out the form with your contact information, a detailed description of your original work, the infringing links, and a sworn statement asserting your rights. Google will evaluate your claim and may request additional documentation—so be prepared to respond promptly. Once approved, the offending URLs will be deli

#3. Hire an SEO Expert

When you partner with crypto-focused reputation strategist Ross Kernez, you gain an expert who knows how to influence search results and control the narrative in a volatile digital landscape. Ross applies a multi-layered strategy—bilingual news placements, purpose-built microsites, high-impact press releases, and synchronized social media efforts—designed to elevate your credibility while suppressing FUD, outdated articles, and hostile forum posts. Every action is custom-built: Ross audits the keywords, platforms, and publishers that shape perception in the crypto space, then powers a content engine that brings your best press forward and moves harmful links out of sight.

Outsourcing this mission isn’t just smart—it’s critical. In the 24/7 world of crypto, your name or project can trend for the wrong reasons in seconds. Reputation management here demands constant vigilance, deep SEO expertise, and messaging that aligns with both mainstream media and blockchain-native communities. With Ross managing your onli

#4. Reaching Out To Journalists

Reaching out to a journalist—or any media outlet—to address unfavorable crypto-related coverage requires tact, professionalism, and a clear, evidence-backed approach. Start by identifying the reporter and publication, then review their correction or update policies to ensure your request aligns with their editorial standards. In your personalized message (avoid templates), acknowledge the journalist’s role in fair reporting and clearly explain—supported by concise, verifiable proof—why the article is outdated, misleading, or factually incorrect. Include documentation or recent developments that reflect the full, current picture. If the facts are technically accurate but the context has shifted, consider suggesting an update that highlights recent achievements or progress. Offering an exclusive quote, interview, or dataset can turn your request into a value-added opportunity for the reporter.

Throughout the exchange, maintain a respectful and cooperative tone. Journalists are under no obligation to revise or remove content, and collaborative engagement is often more productive than confrontation. If the outreach yields no result, incorporate it into a wider crypto reputation strategy—whether that involves legal guidanc

#5. Explore Legal Avenues

Taking a publisher to court under defamation or cyber-crime laws may seem like a straightforward solution, but legal action rarely results in the clean slate most crypto founders and brands envision. Lawsuits can be expensive, drawn-out, and mentally draining—often lasting months or years with no guarantee that the harmful content will be taken down. Worse, filing a case can unintentionally reignite attention, as media outlets report on the lawsuit itself, amplifying the very content you aimed to suppress through what's known as the Streisand effect. The legal bar is high: you must prove that the statements are false, damaging, and made in bad faith—an uphill battle, especially when dealing with opinion pieces or vague allegations. Even a courtroom win can leave the article online, now accompanied by headlines about the legal dispute, and may damage future relationships with reporters who view the move as overly aggressive.

A more strategic approach for crypto companies and leaders is proactive online reputation management. By addressing inaccuracies directly with editors, publishing factual and trust-building narratives in multiple languages, and populating search results with authoritative, positive content, you can reshape public perception—quietly and effectively. This forward-thinking strategy not only protects your digital footprint today but also preserves the goodwill and press relationships

#6. Requesting an Update To An Article To Remove Negative Results

When requesting an update from a journalist covering your crypto project, lead with professionalism, transparency, and solid evidence—not confrontation. Begin your outreach by acknowledging the reporter’s role and commitment to accuracy, then present clear, verifiable proof that the article is outdated, misleading, or incomplete. Strengthen your case with updated data, recent milestones, or new context the original piece may have missed—ideally available in multiple languages for added clarity and accessibility.

Position your request as a mutual effort to maintain factual accuracy, not an attempt to suppress coverage. This collaborative tone encourages goodwill and makes it easier for the journalist to revisit and refine the story. The result is a more balanced piece that protects your reputation, enhances the outlet’s credibility, and helps shift negative search results further down the page—supporting a more favorable digital presence in the highly scrutinized crypto space.

Who We Work With

We provide search suppression services for both individuals and corporations .

Below are some of the types of clients we've been able to work with over the years:

Individuals

1. Celebrities

2. Musicians

3. Politicians

4. Authors

5. Non-public individuals

Business

1. Fortunate 500 companies

2. CEOs & executives

3. Business crises

Advanced Tracking Technology

Our tailored suppression process is supported by advanced tracking technology, specifically designed for our search suppression services. This custom-built solution enables seamless monitoring of your campaign's performance and progress.

Key features of our technology include:

Analyzing sentiment associated with search results

Providing a comprehensive sentiment score

Tracking a wide range of brand-related keywords

Monitoring search results across various locations

With our proven suppression strategies, we effectively pushed negative content off the first page of Google search results.

We can help you push down negative results and secure positive news coverage in 146 countries and 51 languages

All countries

Europe

North America

Central America

South America

Asia-Pacific

Middle East

Africa

Central Asia

Kazakhstan

Mexico

France

U.S.

Serbia

Bangladesh

Bosnia and Herzegovina

Venezuela

Pakistan

U.A.E.

Switzerland

Hungary

Turkey

Romania

India

Spain

Kyrgyzstan

Kenya

Georgia

Vietnam

Slovakia

Peru

Chile

Belgium

Indonesia

Argentina

Germany

Poland

China

Estonia

Azerbaijan

Norway

Lithuania

Nigeria

Austria

Denmark

Portugal

Canada

Italy

U.K.

Malaysia

Finland

Uzbekistan

South Africa

Croatia

Bulgaria

Czech Republic

Australia

Netherlands

Brazil

Ukraine

Moldova

Singapore

Egypt

Philippines

Latvia

Japan

Sweden

Colombia

France

Serbia

Bosnia and Herzegovina

Switzerland

Hungary

Romania

Spain

Georgia

Slovakia

Belgium

Germany

Poland

Estonia

Norway

Lithuania

Austria

Denmark

Portugal

Italy

U.K.

Finland

Croatia

Bulgaria

Czech Republic

Netherlands

Ukraine

Moldova

Latvia

Sweden

Mexico

U.S.

Canada

Venezuela

Peru

Chile

Argentina

Brazil

Colombia

Bangladesh

India

Vietnam

Indonesia

China

Malaysia

Australia

Singapore

Philippines

Japan

U.A.E.

Turkey

Azerbaijan

Egypt

Kenya

Nigeria

South Africa

Pakistan

Kyrgyzstan

Uzbekistan

FAQs

How to Suppress Unwanted News?

What makes a reputation management firm the best choice for wealth managers?

The most effective firms combine deep financial‑industry knowledge with advanced digital PR tactics. They understand the regulatory landscape governing advisors and RIAs, so compliance is never an afterthought. Their teams include SEO specialists, crisis strategists, and former financial journalists who know how to craft authoritative narratives. Because they monitor search results, social media, and niche investment forums in real time, potential issues are addressed before they escalate. This holistic approach protects both brand credibility and client trust.

How do repair services for wealth managers differ from generic reputation solutions?

Repair programs for wealth managers focus on the nuanced reputational risks tied to fiduciary duty and portfolio performance. They prioritize discreet removal or suppression of FINRA complaints, negative Barron’s mentions, and outdated Form ADV disclosures. Generic solutions often overlook these specialized data sets, leaving gaps in online defenses. A tailored strategy ensures every touchpoint—Google, LinkedIn, trade press, and compliance databases—reinforces integrity. As a result, wealth managers maintain the confidence of affluent clients and institutional partners.

Why is online reputation so critical for high‑net‑worth advisors?

Affluent investors vet advisors through digital channels long before an introductory call. A single unflattering headline can erode years of relationship‑building and reduce assets under management. Credibility directly influences referrals, performance fees, and media invitations. In today’s transparent marketplace, silence or inaction is interpreted as guilt. Proactive reputation management safeguards revenue and distinguishes elite advisors from competitors.

Can a top firm remove negative search results entirely?

Complete removal is sometimes possible when content violates platform policies or defamation laws. However, in many cases the more reliable tactic is strategic suppression with new, positive assets that outrank harmful links. Wealth‑manager repair specialists use authoritative press releases, thought‑leadership articles, and high‑domain‑authority backlinks to achieve this. They simultaneously negotiate with publishers for updates or takedowns when factual errors exist. The combined strategy delivers faster, more durable results than removal attempts alone.

How long does a typical reputation repair campaign take?

Timelines vary with the severity of the issue and the authority of negative domains. Mild brand clean‑ups may show noticeable ranking shifts in four to six weeks. More complex crises involving national media coverage can require three to six months of sustained optimization. Throughout the process, firms provide bi‑weekly progress reports and transparent KPIs. This disciplined cadence keeps stakeholders informed and aligned.

What compliance considerations must be addressed during reputation repair?

Financial advisors operate under SEC, FINRA, and state‑level advertising rules. All outgoing content—blogs, interviews, and testimonials—must avoid unsubstantiated performance claims. Reputable firms consult legal teams to pre‑review materials and document substantiation. They maintain audit trails to satisfy potential regulator inquiries. Consequently, reputation gains never come at the expense of regulatory risk.

Do reputation management firms offer crisis response planning?

Yes, leading providers integrate crisis simulations and playbooks into ongoing service packages. They map likely threat vectors such as data breaches, performance dips, or regulatory fines. Media‑training sessions prepare executives with clear, compliant messaging. Real‑time monitoring alerts the team within minutes of negative chatter. Having a rehearsed protocol minimizes response times and dampens news cycles.

How does SEO intersect with reputation repair for wealth managers?

Search‑engine optimization determines which narratives surface first when prospects research an advisor. Repair specialists optimize sanctioned bios, interview transcripts, and thought‑leadership pieces around high‑intent keywords. They earn backlinks from credible finance publications to boost authority. Technical SEO ensures rich snippets, FAQs, and knowledge panels display accurate credentials. Together, these elements crowd out harmful content and elevate positive coverage.

What key performance indicators should wealth managers track during a repair campaign?

Rankings of branded search terms are a primary metric because they shape first impressions. Sentiment analysis across social and forum channels reveals whether perceptions are improving. Domain authority scores of positive assets indicate long‑term defensibility. Lead‑generation data, such as consultation requests, validates commercial impact. Finally, media quality scores assess the credibility of earned placements.

Can repaired reputations remain stable after the engagement ends?

Yes, provided the firm transfers maintenance processes to the advisor’s internal team or PR partner. They supply content calendars, monitoring dashboards, and backlink roadmaps for ongoing upkeep. Quarterly check‑ins help recalibrate tactics as algorithms and regulations evolve. Consistent publishing of authoritative insights keeps positive assets fresh and favored by Google. With discipline, the improved reputation sustains itself and even compounds over time.

How confidential is the repair process for high‑profile wealth managers?

Top‑tier firms operate under strict non‑disclosure agreements and encrypted workflows. Only essential personnel access sensitive client data. Vendor contracts stipulate zero subcontracting without written approval. Cloud storage uses bank‑grade security with multi‑factor authentication. This confidentiality preserves client privacy and prevents additional reputational risk.

What types of negative content are most damaging to wealth managers?

Regulatory enforcement actions, even if later overturned, often top the list because they imply misconduct. Poor performance reviews on investor forums can seed doubt about fiduciary competence. Personal life scandals, such as messy divorces reported in tabloids, undermine perceived stability. Anonymous allegations on complaint boards create lingering uncertainty. Finally, misquoted investment commentary may misrepresent risk tolerance and scare cautious prospects.

How do wealth‑manager‑focused firms handle disgruntled former employees’ posts?

They begin with fact‑finding to verify or refute the claims. If statements breach confidentiality or contain false allegations, legal teams issue takedown requests. Simultaneously, HR success stories and culture awards are promoted to offer balanced perspectives. Search‑result optimization pushes authoritative employer‑brand content above rogue criticisms. The dual legal‑PR approach reduces immediate damage and builds long‑term resilience.

What role does content marketing play in reputation repair?

Quality content positions the advisor as a trusted thought leader, signaling expertise to both clients and search engines. Articles on market outlooks, tax strategies, and philanthropic impact fill SERPs with valuable information. Each piece is optimized with schema markup for enhanced visibility. Syndication through reputable finance outlets amplifies reach and backlink equity. Over time, this library forms a protective moat around the brand.

Are social media platforms important for wealth‑manager reputation strategies?

Absolutely, because affluent clients often vet advisors’ digital presence for credibility cues. LinkedIn acts as a professional proof point and distribution channel for expert commentary. Twitter (now X) enables real‑time engagement on market insights, demonstrating responsiveness. Firms ensure posts comply with advertising rules and use social listening to spot early signs of negativity. Consistent, compliant activity strengthens relationships and signals transparency.

How do firms measure sentiment improvements over time?

They implement AI‑driven social listening tools that categorize mentions as positive, neutral, or negative. Custom dashboards track trend lines and highlight anomalies. Periodic surveys gauge client and partner perceptions directly. Combining quantitative data with qualitative feedback offers a 360‑degree view. These insights inform strategy tweaks and validate ROI.

What sustainable tactics prevent future reputational crises?

Establishing a regular cadence of proactive PR keeps favorable narratives fresh in search results. Implementing strict cybersecurity protocols reduces data‑breach risks that trigger negative press. Training staff on compliant social media use prevents inadvertent violations. Transparent client communication, including quarterly performance letters, minimizes rumor mills. Together, these habits form a durable shield against future threats.

Do firms collaborate with legal counsel during high‑stakes repairs?

Yes, integrated legal‑PR teams ensure public statements align with litigation strategy. Lawyers review outreach materials for defamation exposure and regulatory compliance. They coordinate cease‑and‑desist letters when necessary to curb misinformation. This synergy prevents contradictory messaging and leverages legal leverage where appropriate. Ultimately, it streamlines resolution and preserves brand integrity.

How does reputation repair influence client acquisition and retention?

A cleaner digital footprint increases conversion rates from referrals and cold outreach. Prospects feel reassured when search results highlight awards, community involvement, and positive press. Existing clients gain confidence, reducing attrition during market volatility. Transparent communication about improvements reinforces trust. This virtuous cycle drives sustainable growth.

What budgeting guidelines apply to reputation repair for wealth managers?

Campaign costs correlate with negative result severity, competitive keyword difficulty, and desired speed. Smaller cleanup efforts might start around five figures, while global crises demand six‑figure investments. Firms provide phased milestones so expenses align with measurable progress. Many advisors treat the engagement as brand insurance under marketing budgets. Considering potential AUM losses, the ROI often justifies the spend.

Can reputation firms guarantee specific outcomes?

Ethical providers avoid absolute guarantees because search algorithm dynamics are outside their control. Instead, they commit to mutually agreed KPIs and transparent reporting. Contracts outline performance targets, such as first‑page dominance percentages. Satisfaction clauses may allow partial refunds if minimum thresholds aren’t met. This balance promotes accountability without promising the impossible.

How do firms keep pace with algorithm updates?

They maintain dedicated R&D teams that monitor Google core updates, Reddit indexing changes, and AI‑powered SERP features. Continuous testing of link‑building tactics and CTR optimization informs rapid adjustments. Subscriptions to SEO tool APIs provide real‑time ranking data for swift pivots. Industry partnerships with publishers ensure immediate content distribution when priorities shift. This agility protects gains despite external volatility.

What happens if negative content resurfaces after a campaign ends?

Most firms offer retainer options for ongoing vigilance. Automated alerts flag new or returning threats within hours of publication. Swift reapplication of proven tactics suppresses fresh negativity before it spreads. Quarterly audits assess backlink health and content freshness. This proactive maintenance preserves progress and averts costly relapses.

Do reputation management firms assist with awards and rankings submissions?

Yes, because credible third‑party recognition boosts authority in SERPs and among investors. Teams curate relevant finance‑industry awards and coordinate application packets. They craft compelling narratives that meet judging criteria without breaching compliance rules. Successful placements secure backlinks and media coverage. The resulting accolades further insulate the brand from negativity.

How is success communicated to stakeholders during the project?

Project managers host kickoff calls to define metrics and risk tolerances. Weekly email digests summarize ranking moves, media wins, and sentiment shifts. Monthly video briefings allow live Q&A on strategy pivots. Executive dashboards provide 24/7 access to granular data. This transparency keeps leadership engaged and decisions data‑driven.

What differentiates a top reputation management firm from smaller agencies?

Elite firms possess dedicated finance vertical teams with deep regulatory expertise. They maintain global publisher networks capable of rapid story placement. Proprietary technology offers granular sentiment tracking across dark‑web forums and paywalled databases. White‑glove client service ensures immediate access to senior strategists, not junior account reps. These advantages deliver faster, more reliable outcomes.

Can reputation repair improve recruitment and talent retention?

Yes, because prospective hires also research leadership credibility and workplace culture online. Positive media coverage and Glassdoor sentiment attract high‑caliber candidates. Current employees feel pride and stability when their firm’s reputation is strong. Lower turnover reduces operational disruptions and training costs. This HR advantage compounds the financial ROI of reputation investments.

Is media training included in repair service packages?

Many top‑tier programs bundle on‑camera coaching and message development sessions. Advisors learn to articulate investment philosophies succinctly and handle tough questions calmly. Trainers simulate hostile interviews to build resilience. Recording and playback analysis highlights improvement areas. Mastery of media interactions prevents accidental misquotes that could trigger future crises.

How do firms tailor strategies for multi‑office wealth management practices?

They audit each office’s digital footprint, ensuring local pages comply with jurisdiction‑specific advertising rules. Localized content highlights community engagement and client success stories. Geo‑targeted backlink campaigns strengthen regional search rankings. Central dashboards unify monitoring so leadership sees nationwide trends. This bespoke approach maintains brand consistency while honoring local nuances.

What post‑campaign resources support ongoing reputation health?

Clients receive content calendars, style guides, and compliance checklists. Access to monitoring software continues at discounted rates for alumni. Quarterly strategy sessions benchmark progress against evolving market dynamics. Refresher media‑training workshops keep spokespeople sharp. These resources empower internal teams to steward the refined reputation long term.