I’m Ross Kernez—your trusted expert in Reputation Management for Financial Advisors. With over fifteen years of experience, I help high-net-worth families and their advisors protect their name, navigate public scrutiny, and maintain a discreet yet credible online presence. My proactive strategies go beyond crisis control, focusing on long-term reputation stewardship that reflects your values, governance, and generational legacy.

Reputation Management For Financial Advisors

I’m Ross Kernez, a Reputation Management Consultant with more than 15 years of experience safeguarding the online presence of financial advisors. My services center on Reputation Management for Financial Advisors—removing or suppressing unfavorable press, correcting misleading statements, and amplifying narratives that showcase your fiduciary duty, market insight, and client‑first philosophy.

From SEC references and client disputes to media scrutiny, I ensure your digital footprint mirrors the professionalism and performance your clients rely on. In an industry where trust directly drives AUM, your reputation must be an asset—not a liability. Let’s make sure search results highlight your leadership, reliability, and long‑term value, not digital vulnerabilities.

Reputation Management For Financial Advisors

as seen on

We can Help You to Establish Your Online Presence or Remove Negative Search Results

Speak With an Expert

Do you need online reputation management for financial advisors?

| Option | Effectiveness | Cost |

| #1.Waiting For Negative Articles To Fall Off | Low | Free |

| #2.Submit a DMCA Complaint | Low | Free |

| #3. Hire a Reputation Expert ⭐️Ross Kernez | High | $$ |

| #4. Reaching Out To Journalists | Low | Free |

| #5. Explore Legal Strategies | Medium | $$$ |

| #6. Requesting an Update To a Negative Article | Low | Free |

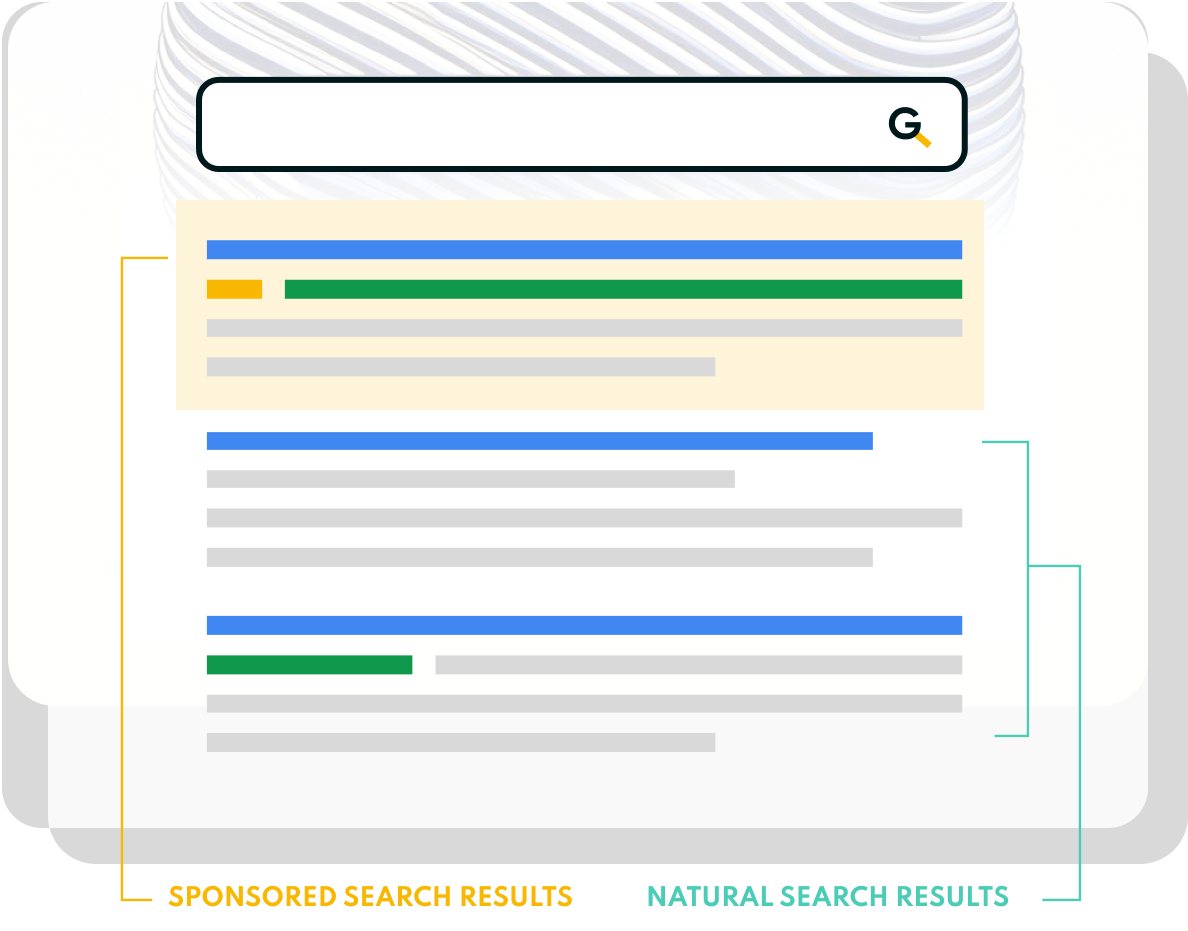

What are Search Results?

Search results refer to the list created by search engines in response to a query. Search results can be broken down as follows:

Natural search results

(usually on the left-hand side of search engine’s results page) and;

Sponsored search results

(usually on the top and right-hand side of a search engine’s results page). Here you will see websites that have placed PAID ads within the search engine.

Who is Ross Kernez?

Why you should remove negative content online

Here’s some feedback from someone who has worked with Ross

How to suppress negative information about you in

Whether you’re battling FUD, fake reviews, or misinformation, I build a stronger online presence that reflects the integrity of your project. Let’s make sure your name—or your token—commands confidence and credibility from page one of Google.

Let's Dive Deeper on How online reputation management works for wealth managers

First, we flood Google with fresh, high-authority coverage your audience can trust—think thought-leadership columns, verified interviews, strategic press releases, and marquee collaborations on publications Google already ranks well in Search and beyond, all optimised for the search terms tied to your name. Next, we harden every digital property you own: your website, bio pages, and social profiles are tightened technically, updated often, and cross-linked so they broadcast relevance and authority. If a news article gets the facts wrong, we lodge a tactful correction with the editor; if content crosses the line into defamation or privacy abuse, we issue formal takedown or de-index requests on solid legal grounds. Finally, we keep a steady drumbeat of positive press and social engagement flowing, so fresh wins rise to the top while outdated or hostile links sink deep into the results—well past page one, where they’re all but invisible.

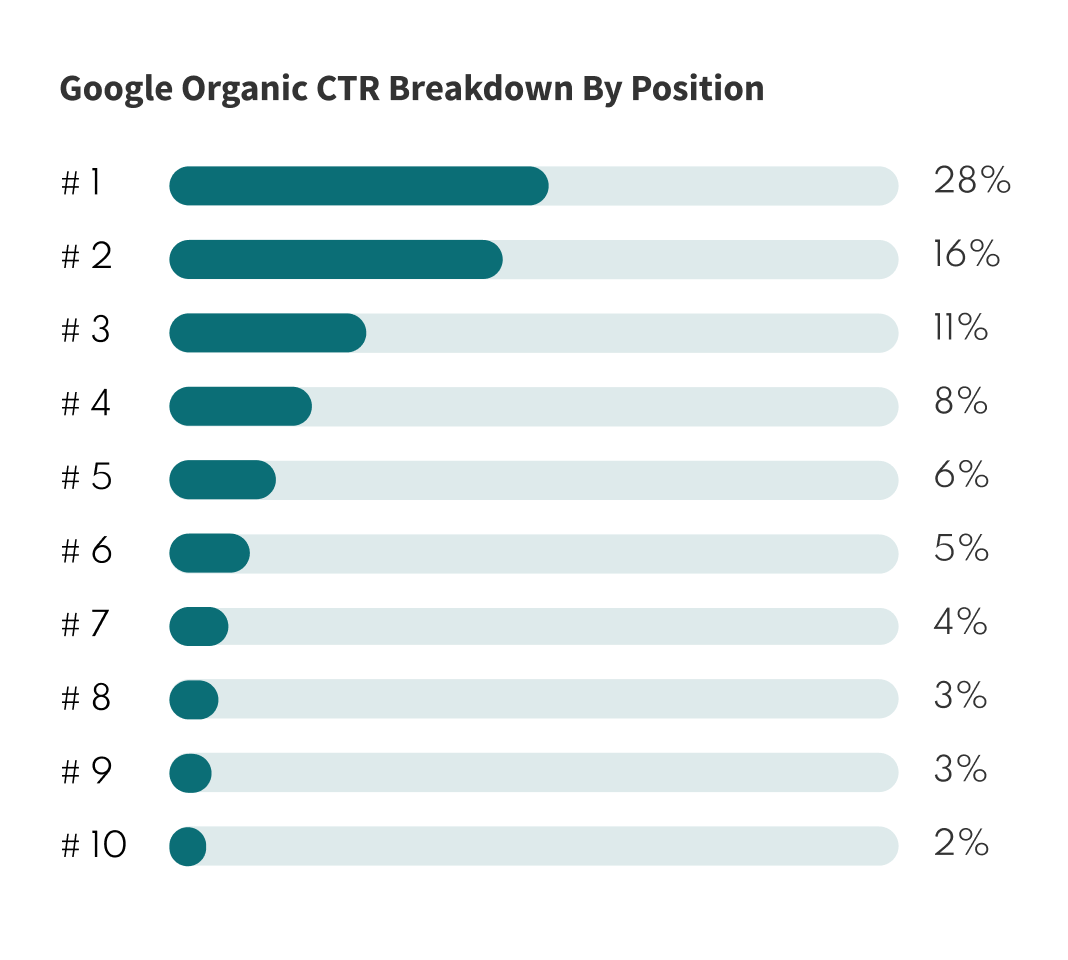

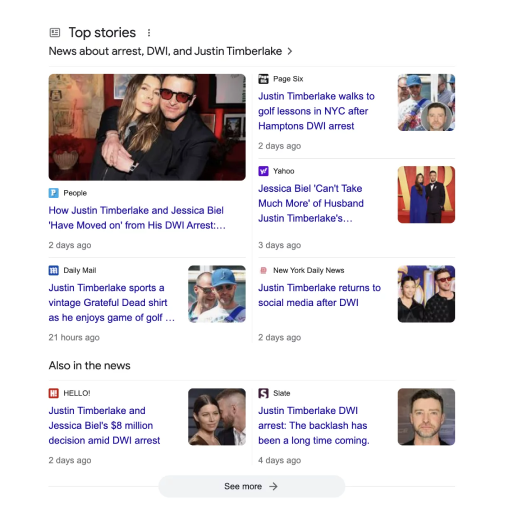

Because Google elevates fresh, authoritative coverage, a single negative headline from a major outlet can vault to the top of your search results—and stay there—simply by virtue of the publisher’s credibility and the story’s recency. That means every new article or broadcast mention effectively renews the shelf-life of the unfavorable narrative, forcing it back onto Page 1 each time it’s updated, syndicated, or quoted. The only reliable countermeasure is to meet Google’s relevance signals with an equally timely stream of positive, high-authority content: an exclusive interview in a respected magazine, a feature on your philanthropic work, or a verified announcement on a well-trafficked platform. By continuously injecting fresh, newsworthy material that reflects your true accomplishments, you can dilute the impact of isolated negative pieces, shift the conversation, and gradually reclaim the real estate at the top of the results page—where first impressions are formed.

Why Google Ranks News Very High in Search?

#1. Waiting For Negative Articles To Naturally Fall Off The First Page

In a competitive investment climate, waiting for negative press to fade on its own is a risk no serious blockchain project should take. If a harmful article or forum thread continues to gain engagement, its visibility won’t fade—it stays on page one, undermining investor confidence and delaying funding.

Our reputation management experts proactively protect your brand. We publish investor-friendly, trust-enhancing content in Arabic and English, fine-tune your digital footprint, and take swift action when your name surfaces in the wrong context. With constant monitoring and precision SEO, we ensure damaging narratives are buried, and your blockchain vision remains the focus.

#2. Submit a DMCA Takedown Notice on Google

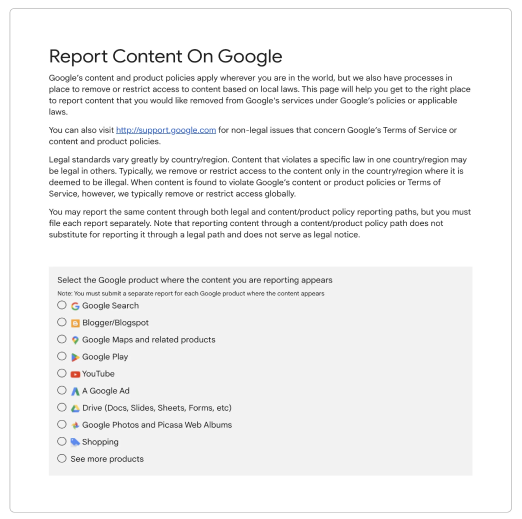

When a regional news outlet or global blog republishes your proprietary content without permission, taking swift action is critical to protect your brand. Start by collecting the infringing URLs and capturing dated screenshots or archived versions that clearly show your ownership. Then, visit Google’s copyright-removal portal (support.google.com/legal/troubleshooter/1114905) and select the appropriate product—Search, YouTube, Images, and more. Fill out the form with your contact information, a detailed description of your original work, the infringing links, and a sworn statement asserting your rights. Google will evaluate your claim and may request additional documentation—so be prepared to respond promptly. Once approved, the offending URLs will be deli

#3. Hire an SEO Expert

When you partner with crypto-focused reputation strategist Ross Kernez, you gain an expert who knows how to influence search results and control the narrative in a volatile digital landscape. Ross applies a multi-layered strategy—bilingual news placements, purpose-built microsites, high-impact press releases, and synchronized social media efforts—designed to elevate your credibility while suppressing FUD, outdated articles, and hostile forum posts. Every action is custom-built: Ross audits the keywords, platforms, and publishers that shape perception in the crypto space, then powers a content engine that brings your best press forward and moves harmful links out of sight.

Outsourcing this mission isn’t just smart—it’s critical. In the 24/7 world of crypto, your name or project can trend for the wrong reasons in seconds. Reputation management here demands constant vigilance, deep SEO expertise, and messaging that aligns with both mainstream media and blockchain-native communities. With Ross managing your onli

#4. Reaching Out To Journalists

Reaching out to a journalist—or any media outlet—to address unfavorable crypto-related coverage requires tact, professionalism, and a clear, evidence-backed approach. Start by identifying the reporter and publication, then review their correction or update policies to ensure your request aligns with their editorial standards. In your personalized message (avoid templates), acknowledge the journalist’s role in fair reporting and clearly explain—supported by concise, verifiable proof—why the article is outdated, misleading, or factually incorrect. Include documentation or recent developments that reflect the full, current picture. If the facts are technically accurate but the context has shifted, consider suggesting an update that highlights recent achievements or progress. Offering an exclusive quote, interview, or dataset can turn your request into a value-added opportunity for the reporter.

Throughout the exchange, maintain a respectful and cooperative tone. Journalists are under no obligation to revise or remove content, and collaborative engagement is often more productive than confrontation. If the outreach yields no result, incorporate it into a wider crypto reputation strategy—whether that involves legal guidanc

#5. Explore Legal Avenues

Taking a publisher to court under defamation or cyber-crime laws may seem like a straightforward solution, but legal action rarely results in the clean slate most crypto founders and brands envision. Lawsuits can be expensive, drawn-out, and mentally draining—often lasting months or years with no guarantee that the harmful content will be taken down. Worse, filing a case can unintentionally reignite attention, as media outlets report on the lawsuit itself, amplifying the very content you aimed to suppress through what's known as the Streisand effect. The legal bar is high: you must prove that the statements are false, damaging, and made in bad faith—an uphill battle, especially when dealing with opinion pieces or vague allegations. Even a courtroom win can leave the article online, now accompanied by headlines about the legal dispute, and may damage future relationships with reporters who view the move as overly aggressive.

A more strategic approach for crypto companies and leaders is proactive online reputation management. By addressing inaccuracies directly with editors, publishing factual and trust-building narratives in multiple languages, and populating search results with authoritative, positive content, you can reshape public perception—quietly and effectively. This forward-thinking strategy not only protects your digital footprint today but also preserves the goodwill and press relationships

#6. Requesting an Update To An Article To Remove Negative Results

When requesting an update from a journalist covering your crypto project, lead with professionalism, transparency, and solid evidence—not confrontation. Begin your outreach by acknowledging the reporter’s role and commitment to accuracy, then present clear, verifiable proof that the article is outdated, misleading, or incomplete. Strengthen your case with updated data, recent milestones, or new context the original piece may have missed—ideally available in multiple languages for added clarity and accessibility.

Position your request as a mutual effort to maintain factual accuracy, not an attempt to suppress coverage. This collaborative tone encourages goodwill and makes it easier for the journalist to revisit and refine the story. The result is a more balanced piece that protects your reputation, enhances the outlet’s credibility, and helps shift negative search results further down the page—supporting a more favorable digital presence in the highly scrutinized crypto space.

Who We Work With

We provide search suppression services for both individuals and corporations .

Below are some of the types of clients we've been able to work with over the years:

Individuals

1. Celebrities

2. Musicians

3. Politicians

4. Authors

5. Non-public individuals

Business

1. Fortunate 500 companies

2. CEOs & executives

3. Business crises

Advanced Tracking Technology

Our tailored suppression process is supported by advanced tracking technology, specifically designed for our search suppression services. This custom-built solution enables seamless monitoring of your campaign's performance and progress.

Key features of our technology include:

Analyzing sentiment associated with search results

Providing a comprehensive sentiment score

Tracking a wide range of brand-related keywords

Monitoring search results across various locations

With our proven suppression strategies, we effectively pushed negative content off the first page of Google search results.

We can help you push down negative results and secure positive news coverage in 146 countries and 51 languages

All countries

Europe

North America

Central America

South America

Asia-Pacific

Middle East

Africa

Central Asia

Kazakhstan

Mexico

France

U.S.

Serbia

Bangladesh

Bosnia and Herzegovina

Venezuela

Pakistan

U.A.E.

Switzerland

Hungary

Turkey

Romania

India

Spain

Kyrgyzstan

Kenya

Georgia

Vietnam

Slovakia

Peru

Chile

Belgium

Indonesia

Argentina

Germany

Poland

China

Estonia

Azerbaijan

Norway

Lithuania

Nigeria

Austria

Denmark

Portugal

Canada

Italy

U.K.

Malaysia

Finland

Uzbekistan

South Africa

Croatia

Bulgaria

Czech Republic

Australia

Netherlands

Brazil

Ukraine

Moldova

Singapore

Egypt

Philippines

Latvia

Japan

Sweden

Colombia

France

Serbia

Bosnia and Herzegovina

Switzerland

Hungary

Romania

Spain

Georgia

Slovakia

Belgium

Germany

Poland

Estonia

Norway

Lithuania

Austria

Denmark

Portugal

Italy

U.K.

Finland

Croatia

Bulgaria

Czech Republic

Netherlands

Ukraine

Moldova

Latvia

Sweden

Mexico

U.S.

Canada

Venezuela

Peru

Chile

Argentina

Brazil

Colombia

Bangladesh

India

Vietnam

Indonesia

China

Malaysia

Australia

Singapore

Philippines

Japan

U.A.E.

Turkey

Azerbaijan

Egypt

Kenya

Nigeria

South Africa

Pakistan

Kyrgyzstan

Uzbekistan

FAQs

How to Suppress Unwanted News?

What is Online Reputation Management for Financial Advisors and why is it essential today?

Online Reputation Management for Financial Advisors is a strategic process that monitors, shapes, and protects the digital profiles of professionals who guide clients’ investments and wealth. Because prospective clients almost always search online before making first contact, an advisor’s web presence often decides whether that inquiry happens at all. A single negative headline or unanswered review can overshadow years of impeccable service and fiduciary integrity. A robust reputation program ensures positive press, compliant thought leadership, and authoritative content dominate page‑one search results. It transforms digital impressions into a steady pipeline of qualified prospects who already trust the advisor’s credibility.

How can negative search results impact a financial advisor’s client acquisition strategy?

Unfavorable stories in top search positions create doubt about competence, ethics, or stability, prompting prospects to keep looking. Even if the content is outdated or disproven, confirmation bias can cause readers to remember only the negative takeaway. Lost trust usually translates into lower conversion rates from website visits, referral calls, and seminar sign‑ups. Advisors then spend extra time explaining or rebutting issues instead of discussing financial goals. Proactive suppression and counter‑narrative content restore control over the conversation and shorten the sales cycle.

Which digital assets should financial advisors monitor most closely to maintain a strong online reputation?

Key assets include the advisor’s personal LinkedIn page, the firm’s website bio, Google Business Profile, and BrokerCheck record, because these usually appear first in branded searches. High‑authority guest articles and podcast appearances also deserve routine audits, as outdated performance claims can trigger compliance concerns. Social‑media mentions on X, Reddit finance communities, and local Facebook groups can quickly escalate into reputational threats if left unaddressed. Review platforms such as Yelp and WalletHub increasingly influence perceptions of service quality, especially among younger investors. Consistent monitoring across all these touchpoints ensures early detection and swift remediation.

How does compliance with FINRA and SEC regulations intersect with online reputation efforts?

FINRA Rule 2210 and the SEC’s investment adviser marketing rule set strict standards for communications that could be construed as advertising or promissory. All public content—blogs, videos, social posts—must undergo compliance review to avoid misleading statements, cherry‑picked performance, or unauthorized testimonials. Reputation specialists collaborate with chief compliance officers to build approval workflows and maintain archival records for audits. Automated archiving of every web change safeguards against inadvertent violations. By embedding compliance into reputation strategy, advisors strengthen trust with both regulators and clients.

Can positive client testimonials be used in online reputation campaigns without violating industry rules?

Yes, but strict guidelines apply to ensure transparency and balanced presentation. Advisors must disclose whether testimonials are compensated, confirm that clients’ experiences are typical, and avoid statements promising future results. Proper context—such as noting that market conditions vary—helps prevent misinterpretation. Testimonials should appear alongside broader educational content to reinforce authenticity and value. When executed correctly, compliant endorsements become powerful social proof that boosts online credibility.

What role does content marketing play in Online Reputation Management for Financial Advisors?

Authoritative articles, white papers, and explainer videos position advisors as thought leaders who understand complex financial topics and regulatory nuances. Search engines reward consistently high‑quality content with greater visibility, pushing down less favorable links. Educational pieces that answer common investor questions attract organic traffic and earn backlinks from reputable finance sites. Content also humanizes the advisor, showing empathy and expertise in a medium that builds trust before first contact. Over time, a robust content library becomes a defensive moat against future reputation threats.

How long does it typically take to see measurable improvements in search engine results after launching a reputation program?

Initial shifts can emerge within six to eight weeks as new, optimized content gets indexed and begins climbing the rankings. Tangible suppression of entrenched negative results often requires three to six months, depending on their domain authority and backlink profile. Algorithm updates or fresh media coverage can extend timelines, so constant monitoring and agile tactics remain critical. Advisors who pair technical SEO with strategic public‑relations outreach usually experience faster gains. Patience, persistence, and data‑driven adjustments ensure durable results rather than short‑lived boosts.

Are paid advertorials effective for boosting a financial advisor’s online reputation, or can they damage credibility?

Paid placements in reputable outlets deliver quick visibility and high‑domain‑authority backlinks, but transparency is paramount. Clearly marked “sponsored content” prevents accusations of stealth advertising and maintains regulatory compliance. High editorial standards, data‑driven insights, and balanced tone minimize perceptions of overt self‑promotion. When blended with earned media and organic content, advertorials contribute to a diversified reputation strategy. Overreliance on paid pieces, however, can erode authenticity, so advisors should treat them as a supplement, not a substitute.

How does social media engagement affect a financial advisor’s professional reputation?

Verified social profiles allow advisors to share timely market insights and respond to client concerns, demonstrating accessibility and expertise. Consistent, compliant posting displaces impersonators or outdated information from top search results. Audience interactions—likes, comments, shares—serve as real‑time sentiment indicators, highlighting what resonates and where clarification is needed. Social listening tools surface emerging rumors before they escalate into broader crises. Thoughtful engagement builds emotional connections that formal reports alone cannot achieve.

What are the first steps in recovering from a reputational crisis caused by a regulatory action?

Immediate acknowledgment of the issue, coupled with a factual statement approved by compliance and legal teams, prevents speculation from spreading unchecked. Simultaneously, advisors should publish transparent FAQs explaining lessons learned, corrective measures, and future safeguards. Coordinating with media outlets to provide context and share remediation progress reframes the narrative toward responsibility and growth. Targeted SEO campaigns promote this fresh content, gradually replacing early negative coverage in search rankings. Ongoing monitoring ensures that residual conversations remain accurate and balanced.

Can Online Reputation Management for Financial Advisors help mitigate the impact of market downturns on client confidence?

Proactive communication of market perspectives, risk‑management strategies, and historical context reassures clients when volatility strikes. Positive, educational content ranking high in search results counters sensational headlines warning of financial doom. Timely webinars and blog updates demonstrate leadership and accessibility, reinforcing trust during uncertain periods. Social‑media engagement lets advisors address anxieties in real time, reducing rumor‑driven panic. Consistent expertise on display strengthens long‑term relationships and links the advisor’s brand to stability rather than fear.

How do review platforms like Google Business Profile influence prospective clients’ perceptions of financial advisors?

Search engines often display star ratings and snippets directly in branded results, making first impressions instantaneous. A pattern of negative or unanswered reviews can deter prospects before they even visit a website. Encouraging satisfied clients to leave balanced, compliant feedback boosts overall ratings and search visibility. Professional responses to critiques showcase accountability and client‑centric culture, further enhancing reputation. Review management therefore becomes a pivotal component of any advisor’s digital strategy.

What strategies can suppress outdated or misleading articles about a financial advisor?

Publishing high‑authority thought‑leadership pieces on outlets such as Barron’s or CFA Institute drives fresh links that outrank older stories. Optimizing existing web pages with structured data and internal links increases their relevance scores, propelling them above unfavorable content. Press releases covering certifications, community service, and speaking engagements inject positive, timely news into search indexes. Outreach campaigns secure podcast interviews and event recaps that populate knowledge panels with favorable references. Collectively, these tactics push misleading articles beyond the visibility threshold where few users click.

How do cybersecurity incidents influence a financial advisor’s digital reputation, and how can they be addressed?

A data breach can raise doubts about the advisor’s ability to safeguard clients’ sensitive information, potentially triggering regulatory inquiries. Transparent disclosures that outline incident scope, remediation steps, and new security protocols demonstrate responsibility and resilience. Third‑party security certifications showcased on the website rebuild confidence by proving adherence to best practices. Educational content on cyber hygiene positions the advisor as a proactive guardian of client assets. Continuous monitoring detects suspicious activity early, preventing repeat incidents from compounding reputational harm.

Is local SEO important for financial advisors who operate nationally, and how does it tie into reputation management?

Local SEO optimizes visibility for location‑based queries like “financial advisor near me,” capturing prospects who prefer in‑person guidance. Accurate NAP (Name, Address, Phone) citations across directories reinforce authority and prevent confusion. Local press coverage and community‑focused blog posts generate geographically relevant backlinks that bolster overall domain strength. Favorable local search results also lend authenticity and approachability to the advisor’s broader national image. By uniting local and national strategies, advisors expand reach while strengthening trust at every level.

How can advisors differentiate themselves online in a crowded wealth management market?

Unique value propositions—such as niche expertise in sustainable investing or retirement planning for physicians—should headline web copy and metadata. Story‑driven content that showcases personal background, client success narratives, and philanthropic efforts fosters emotional connection. Multimedia assets like explainer videos and infographics break down complex concepts in engaging formats. Collaboration with recognized industry influencers amplifies reach and lends third‑party credibility. Consistent messaging across platforms solidifies brand identity and makes the advisor memorable.

What key performance indicators should financial advisors track to evaluate the success of their reputation efforts?

Page‑one sentiment balance indicates whether positive content outweighs negative or neutral links. Organic search traffic growth shows increasing visibility among high‑intent prospects. Engagement metrics—time on page, scroll depth, social shares—reveal resonance of thought‑leadership assets. Conversion rates from inbound inquiries to booked consultations demonstrate bottom‑line impact. Backlink domain authority trends confirm the long‑term strength and defensibility of the advisor’s digital footprint.

How do podcast appearances and webinars strengthen a financial advisor’s reputation?

Podcast interviews allow nuanced discussion of market insights, humanizing the advisor and demonstrating depth of knowledge. Show notes and transcripts create SEO‑rich text that positions the episode in long‑tail search results. Webinars offer interactive education, letting attendees gauge expertise through live Q&A. Recordings repurposed into blog posts, social clips, and email campaigns expand content reach. These formats collectively build authority, attract backlinks, and foster trust among diverse audiences.

Can a financial advisor repair damage from a past lawsuit or arbitration disclosure appearing on the first page of Google?

Strategic content creation and link‑building can push the disclosure to lower pages where discovery rates drop sharply. Contextual articles explaining the resolution, compliance changes, and lessons learned reframe the narrative toward growth and accountability. Collaboration with legal counsel ensures that public statements remain accurate and regulation‑compliant. Ongoing engagement with satisfied clients and community organizations generates fresh, positive news coverage. While complete erasure is rare, effective suppression and context significantly reduce reputational drag.

What role do backlinks from reputable financial publications play in Online Reputation Management for Financial Advisors?

High‑authority backlinks act as votes of confidence in the eyes of search algorithms, lifting linked pages above competing content. Features in outlets like Financial Planning or InvestmentNews signal industry recognition, reinforcing perceived expertise. Earned links diversify traffic sources, lowering dependence on any single platform. Press coverage also provides quotable proof points for marketing collateral and social posts. Together, these benefits create a virtuous cycle of visibility and credibility.

How does proactive reputation monitoring prevent issues from escalating?

Real‑time alerts flag mentions of the advisor’s name, firm, or branded keywords across news, blogs, and social channels. Early detection enables swift factual responses before rumors harden into public opinion. Trend analysis identifies recurring concerns that can inform future content and service improvements. Continuous monitoring also tracks the effectiveness of suppression tactics, allowing timely optimization. Preventive vigilance saves time, money, and emotional energy compared with full‑scale crisis response.

Should financial advisors respond publicly to negative comments on social media?

A measured, compliant reply shows accountability and customer‑centric culture, which often impresses onlookers more than silence. Responses must avoid disclosing personal or account information to maintain privacy and regulatory compliance. Inviting the commenter to continue the conversation privately demonstrates willingness to resolve issues constructively. Following up publicly once the matter is resolved showcases transparency and service quality. Consistent, respectful engagement can turn critics into advocates and strengthen community trust.

How often should a financial advisor publish new content to reinforce a positive online presence?

Posting one to two high‑quality thought‑leadership articles per month keeps search engines indexing fresh material without overwhelming compliance workflows. Weekly social updates maintain visibility and foster ongoing dialogue with followers. Quarterly white papers or market outlook reports provide deeper insights and generate substantial backlink opportunities. Repurposing older content with updated statistics refreshes SEO value while saving production time. Consistency, relevance, and quality together outweigh sheer volume.

What is the relationship between personal branding and firm branding in reputation management?

An advisor’s personal brand humanizes the firm, adding relatable stories and unique perspectives that resonate with clients. Meanwhile, the firm’s institutional brand conveys scale, resources, and operational strength. When aligned, the two create a holistic narrative of trustworthy expertise backed by robust infrastructure. Coordinated style guides, messaging frameworks, and cross‑linking strategies prevent mixed signals. Unified branding amplifies search authority and client confidence more effectively than siloed efforts.

How can financial advisors leverage community involvement to boost online reputation?

Sponsoring local events, volunteering, or hosting financial literacy workshops generates positive press and backlinks from regional news outlets. Community engagement content highlights the advisor’s commitment to social responsibility, appealing to values‑driven investors. Photos and recaps shared on social media humanize the brand and encourage user‑generated content. Local partnerships often lead to speaking invitations and media quotes that expand authority. Authentic community ties differentiate the advisor from larger, impersonal institutions.

Why is mobile search optimization critical for Online Reputation Management for Financial Advisors?

More than half of financial queries now originate from smartphones, meaning first impressions often occur on small screens. Mobile‑friendly pages load faster, reducing bounce rates that could otherwise harm search rankings. Clear navigation and readable fonts prevent user frustration that might translate into negative sentiment. Google’s mobile‑first indexing prioritizes sites optimized for handheld devices, so poor mobile performance can bury positive content. A seamless mobile experience enhances credibility and accessibility simultaneously.

What post‑engagement safeguards can prevent future reputation threats?

Implementing registrar‑lock features, multi‑factor social‑media authentication, and routine compliance audits closes technical vulnerabilities that attackers exploit. Automated renewal monitoring prevents domain expirations that lead to spoof sites or phishing. Employee social‑media guidelines reduce accidental disclosures or off‑brand commentary that could spark controversy. Ongoing sentiment analysis detects subtle shifts in public perception, prompting proactive clarification. These safeguards create a fortified digital perimeter that keeps reputational risks at bay.

How does video content influence trust and credibility for financial advisors?

Visual storytelling simplifies abstract financial concepts, making the advisor’s expertise tangible and relatable. On‑camera presence conveys authenticity through tone and body language in ways text alone cannot match. Platforms like YouTube provide additional search channels where optimized descriptions and transcripts drive organic discovery. Video snippets repurposed on social media increase engagement and shareability, expanding reach. High production values paired with clear disclosures reinforce professionalism and compliance.

Can Online Reputation Management for Financial Advisors improve recruitment of top talent?

Prospective employees research leadership reputations and workplace culture online before accepting interviews or offers. A polished digital presence featuring thought‑leadership accolades and positive employee testimonials signals growth opportunities and ethical standards. Suppressing negative coverage about past turnover or compliance issues removes deterrents that might scare away skilled candidates. Highlighting community involvement and professional development programs showcases an environment where talent can thrive. A strong reputation thus attracts top advisers who further elevate the firm’s brand.

Why choose a specialized reputation service over a generic marketing agency for a financial advisor’s online presence?

Financial‑services specialists understand the regulatory landscape, tailoring tactics to FINRA and SEC requirements that generic agencies may overlook. Established relationships with niche finance publications accelerate high‑authority coverage that directly influences investor perceptions. Specialized teams integrate compliance review into every deliverable, reducing revision cycles and legal risk. Metrics and reporting frameworks focus on KPIs that matter to advisory businesses, such as AUM growth and lead quality. Ultimately, a specialist delivers faster, safer, and more meaningful results for the unique challenges advisors face online.